Table of Content

- What Are the Pros and Cons of a Leaseback for Homeowners?

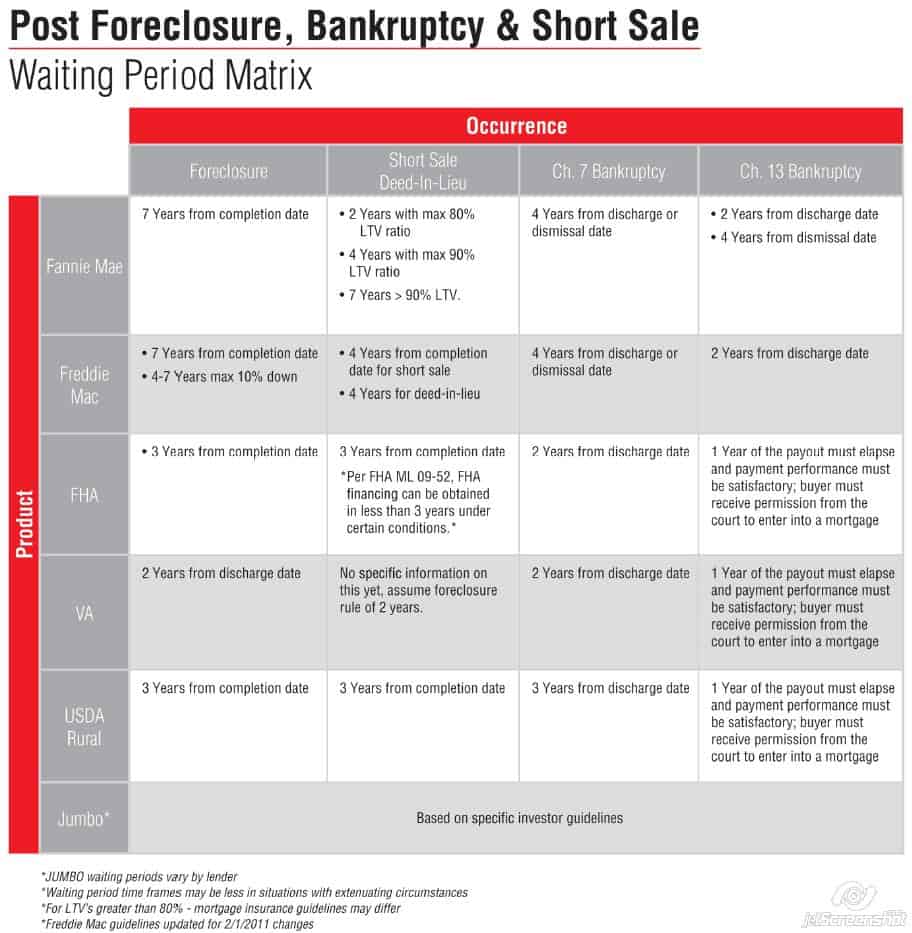

- How Foreclosure Prolongs a Mortgage Waiting Period

- Can Bankruptcy Stop Your Eviction?

- Know Your Lenders: Interviews and Lender Calls

- FHA Guidelines On Mortgage Part of Bankruptcy

- What Is A Hero Mortgage Loan

- Mortgage Options With Bankruptcy and Foreclosure at the Same Time

That will tell you the appropriate purchase price range to look for and will give you an idea of what your monthly payment will be. A big reason to do a leaseback is the fact that it will get you all of the equity in your home. With a bankruptcy on your record, you will probably qualify for less than that. If home sales in your market are strong, you’d like to take advantage of that and sell your home now.

If you have made at least 12 months of payments toward this plan, you may be eligible if the trustee or judge overseeing your bankruptcy approves the application. Like Chapter 7 bankruptcy, you need to meet financial and income standards to be approved. Chapter 13 bankruptcy is often called “reorganization” bankruptcy and usually involves a repayment plan that can help you pay debts without selling property. If you satisfactorily completed the repayment plan, you can be eligible for a VA loan.

What Are the Pros and Cons of a Leaseback for Homeowners?

LendingTree does not include all lenders, savings products, or loan options available in the marketplace. LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Selling your home and leasing it back from the buyer will get you all of your equity quickly with no debt payments.

If the trustee sells the house, it will be sold to the highest bidder. The trustee then takes the remaining amount from the sell of the house to pay creditors. After all creditor payments and trustee fees are covered, any remaining funds would go to Linda .

How Foreclosure Prolongs a Mortgage Waiting Period

To qualify for a bankruptcy in under two years, youll need to be able to show that your bankruptcy was necessitated by extenuating circumstances and unlikely to reoccur. You will also need to demonstrate that you can manage your finances since your bankruptcy occurred. The general rule is to wait two years after your Chapter 7 bankruptcy is discharged before you can reasonably expect to qualify for a home loan. If you’ve been bankrupt previously, your name is placed on the National Hunter database. This is a database containing everyone who’s been bankrupt – even after theyve been discharged. Regardless of whether you own up to it, a lender will be able to find you on this database.

This can be a huge benefit to you as you rebuild your financial life. Even though the ability to declare yourself bankrupt is found in federal law, the states have a lot to say about how your property is affected. Other banks may insist that you wait until 5-7 years afterward, and others will not approve you unless the bankruptcy is off your report entirely. To keep from losing your home, you are also not allowed to access your home’s equity during the bankruptcy process.

Can Bankruptcy Stop Your Eviction?

Speak to an experienced bankruptcy lawyer from the Van Horn Law Group. Some banks might consider giving you a home equity loan as soon as three years after bankruptcy, but again, it mostly depends on how you work to repair your credit during that time. Other banks may insist that you wait up to 5-7 years after that, and others won’t approve you unless bankruptcy is entirely out of your report.

A bankruptcy discharge is an order from a bankruptcy court that releases you from any liability on certain debts and prohibits creditors from attempting to collect on your discharged debts. All of the above waiting periods can be impacted, and potentially increased, if your bankruptcy included a foreclosure. In that case, the FHA loansâ waiting period increases to 3 years and conventional loans increases to 7 years. Both VA and USDA loans remain the same, at 2 and 3 years, respectively. Proving extenuating circumstances can reduce the waiting period.

Can I Get A Mortgage Loan After Chapter 7

Your eligibility for a Chapter 7 bankruptcy is based on income. You generally qualify for a Chapter 7 bankruptcy if you’re below the median income level for your state. If your income is above the median level, a “means test” is applied to determine your ability to pay back the debts you are trying to dismiss. You don’t have to give up on the American dream of becoming a homeowner just because you filed a bankruptcy. You can absolutely get a mortgage after a Chapter 7 bankruptcy. The larger question is when are you able to qualify for a mortgage, which can vary based on the type of loan you are pursuing.

Start by checking websites like Realtor.com and Zillow.com when valuing your home before bankruptcy.Subtract the mortgage balance. The amount necessary to pay the loan and any liens in full.Find out how much equity you can exempt. The homestead exemption covers equity in a home in which you reside. The wildcard exemption might cover an additional amount, but not all states offer a wildcard exemption or allow filers to use it for real estate. However, if you have nonexempt equity, you’ll have to pay an equivalent amount toward your general unsecured debts through your repayment plan.

Learn the ins and outs of a home equity loan vs. a home equity line of credit to decide which option is best for your financial goals. Every homeowner who applies for a HELOC or home equity loan will need to meet lender requirements. The sale of the property will be easier than selling to another homeowner. There will not be any brokers or lenders involved, so there is less paperwork and fewer inspections.

Your creditors cannot contact you after you file for bankruptcy, nor can they attempt to collect payment for medical bills, credit card debts, personal loans, or other types of debt. The filing of bankruptcy is a life-changing experience, but there are some things you should not do before filing. A large number of people try to avoid bankruptcy laws by concealing or giving away assets that should be disclosed in a bankruptcy filing. Approximately 5% of people who file for bankruptcy do so by themselves. If you give your loved one a gift of good will with the understanding that they will return it later, you are not allowed to give it away. Giving your car to a family member before filing for bankruptcy is a simple way to lose it.

This means that if the value of your house is excluded and you are allowed to keep it, the condition is that the value remains in the house and the owner is not allowed to access it in cash. You’ll pay closing costs that will increase your loan balance or require cash. Closing costs typically range from 2% to 5% of the loan amount, which you can pay upfront or wrap into your loan.

A leaseback is when you sell your home to an investor and then lease it back from them as their tenant. If you are looking for a HELOC after bankruptcy, you may not get the maximum LTV, which means that you won’t be able to use as much of your equity. However, other investments may give you a higher return than annual property value appreciation.

What Is A Hero Mortgage Loan

There are a lot of balls to juggle when getting a mortgage after bankruptcy. Besides the variety of mortgages available, all with their own rules, there are also different types of bankruptcy. Both factor in to how long you have to wait before you can apply for a mortgage after bankruptcy is discharged.

No comments:

Post a Comment